EMILY HIEBER AUGUST 27, 2019

The United States is no stranger to extreme weather; According to the NOAA National Centers for Environmental Information, between 1980 and 2019, there have been 250 billion-dollar weather and climate disaster events in the U.S. Severe Storms and Tropical Cyclones accounted for the greatest number of events at 109 and 42, respectively. Together these two disasters have generated $1.17 trillion in CPI-adjusted losses over the same period, representing 68.7% of total losses from all 250 events (National Oceanic and Atmospheric Administration).

The U.S. has averaged 12.6 billion-dollar disaster events annually between 2014 and 2018. In 2019 alone, as of July 9, there have been 6 weather and climate disaster events with losses exceeding $1 billion. 2017 saw the highest costs ever, with cumulative costs of 16 separate billion-dollar weather events totaling $306.2 billion. It is estimated that Hurricane Harvey, which made landfall on the Texas Gulf Coast on August 25th, 2017, accounted for 41.8% ($125 billion) (National Oceanic and Atmospheric Administration, n.d.).

The devastation left behind by these events highlight the necessity for a wide range of stakeholders (at the local, regional and national level) to take proactive action to develop physical and socio-economic resilience to the escalating impacts of extreme weather events. Specifically, the increased frequency and severity of these disasters has prompted a paradigm shift in addressing climate change from a post-disaster financial assistance approach to preventative mitigation initiatives. One place this proactive shift is visible is the in the growing demand for FORTIFIED Home™ construction.

The purpose of this report is to highlight recent efforts taken at local and state levels to build physical and financial resilience to extreme weather events, and explore how measures such as retrofitting and implementation of robust building standards established under the Insurance Institute for Business& Home Safety (IBHS) FORTIFIED program are being used to reduce existing risks or prevent new risk for individuals and communities most susceptible to coastal weather disasters.

Who are the stakeholders and what actions are they taking to encourage socio-economic resilience against climate change?

1. The Insurance Institute for Business & Home Safety (IBHS)

The Insurance Institute for Business & Home Safety (IBHS) is a non-profit 501(c)(3) research and communication organization supported by property insurance and reinsurance industries. IBHS developed the FORTIFIED Home program to promote construction and retrofitting of homes for resilience to natural disasters.

What is FORTIFIED?

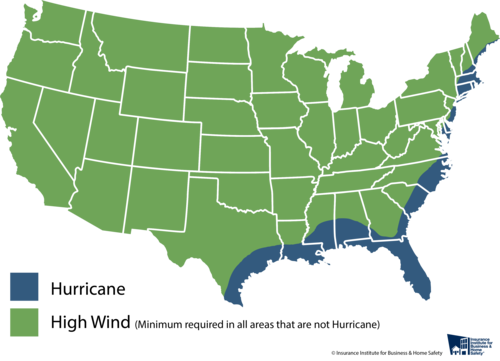

According to IBHS, FORTIFIED is a nationally recognized building method that goes beyond building codes to strengthen residential and commercial buildings against specific natural hazards such as high winds and hurricanes. The standards are backed by 20 years of research and real-world testing; at a research center in South Carolina, IBHS put entire buildings through real-world disaster situations, including hail, wildfire, and winds up to 130 mph (IBHS, 2019).

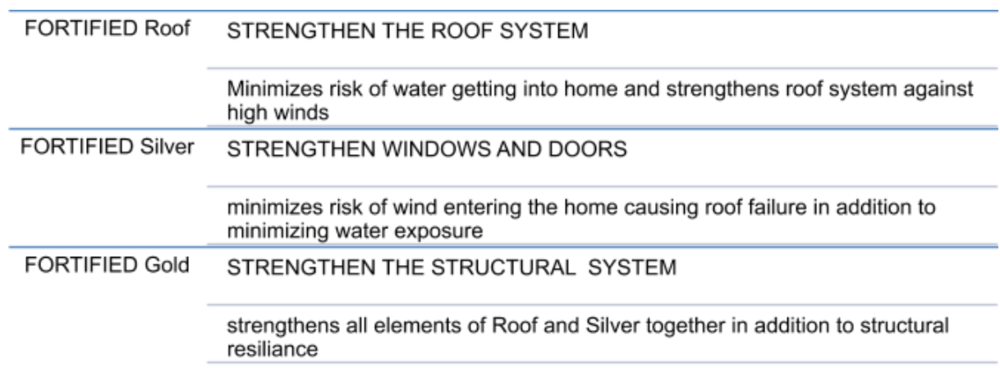

The FORTIFIED Home program has three levels of designation:

The program structure is a tiered additive approach that allows the property owner to build on previous efforts and investment in construction costs; a property can remain at the Roof level designation or build up towards a Gold level.

Designations are attached to a property’s address for 5 years before renewal is required. The designations are provided by trained evaluators across a number of states. When first introduced in 2008 by IBHS, initial interest in FORTIFIED was largely limited to Alabama and the growth in the number of houses meeting designation was tepid. Bloomberg Technology states, between 2008 and 2014 the number of homes meeting the FORTIFIED designation had grown from 1,122 to 1,638; however by 2018 the number increased ten-fold to 11,031 homes and in the first four months of 2019 alone that number has moved to 12,530 (Efstathiou Jr. & Gopal, 2019). The exponential jump in designations highlights the growing frequency of weather disasters and the desire to take proactive measures to reduce the human and economic toll they have on communities.

2. State Level Mitigation Efforts

Alabama

Strengthen Alabama Homes & Smart Home America

Alabama’s interest in FORTIFIED stems from the vast devastation brought by Hurricanes Ivan and Katrina prompted creation of Smart Home America (SHA) a non-profit organization focused on supporting resiliency efforts to protect against severe storms.

Implementation of FORTIFIED was given impetus in 2009 after State legislature passed SB500 (Act 2009-500) which recognized FORTIFIED as the state standard for resiliency construction. In 2015, AL 2015-SB254 expanded recognition of FORTIFIED construction standard state-wide to allow residential and commercial property owners insurance discounts for structures retrofitted to FORTIFIED standards.

For both residential and commercial property owners wind mitigation discount benchmarks, applicable in coastal Alabama, are predicated on the FORTIFIED designation level the property meets. Properties obtaining the FORTIFIED Roof standard can qualify for insurance discounts in the range of 25%-35%; for properties obtaining the FORTIFIED Silver standard insurance discounts can range 35% – 45%, with the greatest range of insurance discounts of 45%-55% available for properties meeting the max standard FORTIFIED Gold (IBHS, 2019). While IBHS develops and implements the FORTIFIED program, the organization does not support mandatory premium discounts.

Coastal Alabama Partnership (CAP) states, that following the first FORTIFIED home build in Fairhope in 2010, the FORTIFIED program gained rapid state-wide traction, with designations growing at a rate of 137% in 2015 alone (Coastal Alabama Partnership , 2015). The popularity of the program led to a grant partnership with Alabama and Smart Home America called Strengthen Alabama Homes. The program provides up to $10,000 in grant funding to primary homeowners with residences in Mobile or Baldwin Counties. The funding can be used to cover the construction costs to retrofit property to FORTFIED standards.

South Carolina

Homeowner Mitigation Credits & SC Safe Home

As ofFebruary 2019, of the country’s 12,350 FORTIFIED-designated homes, 9,227 or (87.0%) of them are in Mobile and Baldwin Alabama, easily making the state a leader in better built homes to withstand severe hurricane damage, according to AL.com (Sharp, 2019). Alabama is not alone in its resiliency efforts; Mississippi, Oklahoma, and South Carolina have all taken state level initiatives, in the form of model legislation and grant programs that support community resilience and mitigation efforts.

In South Carolina, legislation relating to 2016-2017 General Assembly Act 28 which amended aspects the Omnibus Coastal Property Insurance Reform Act of 2007, requires insurers admitted by the state to offer premium discounts, on portions of premium attributable to wind losses, for mitigation measures that strengthen coastal homes and business against hurricane damage. South Carolina Department of Insurance (SCDOI) conducted a survey of property insurers and found that homeowners who took advantage of the mitigation program , save on average annually 14% on property insurance premiums (South Carolina Department of Insurance , 2016).

Mississippi

Model Legislation MS 2012- HB 1410

In Mississippi, MS 2012-HB 1410 legislates insurance discounts for building to FORTIFIED standards. Initially, rules developed in 2010 from the Mississippi Insurance Department encouraged private insurers to offer mitigation discounts on a voluntary basis through mid-2013. After that, the program became mandatory for all residential insurers. According to Maroney et al, homes modified to the FORTIFIED retrofit standards can receive the following insurance credits; 17% at the Roof level, 25% at the Silver level, and 30% at the Gold level (Maroney, Medders, & Nyce, 2015).

Oklahoma

Model Legislation OK 2017 – HB 1720

In Oklahoma, OK 2017 – HB 1720 establishes FORTIFIED Home High Wind standards as the state’s mitigation standard and requires insurers to provide discounts to FORTIFIED property owners (Oklahoma Insurance Department, 2017). The law went into effect on April 1, 2018. Specific data on the impact of Oklahoma’s legislation has been hard to track; however, FORTIFIED home construction garnered broader exposure in the state through Central Oklahoma Habitat for Humanity when the organization incorporated its standards into its home building (Mize, 2018)

Texas

Bolivar Peninsula -FORTIFIED for Safe Living & HUD Community Development Block Grant

In 2008, the storm surge associated with Hurricane Ike devastated the Bolivar Peninsula east of Galveston and most of the homes built to or just above the 100-year flood plain elevation were entirely wiped out. However, highlighted in an IBHS report were the 13 homes on the Bolivar Peninsula that had been constructed using the IBHS FORTIFIED for Safer Living standard when Ike made landfall. After the storm, 10 of the 13 FORTIFIED homes remained standing with minimal damage. Of the three that did not survive, destruction was caused by debris impact from traditionally built homes that were knocked off their foundations (IBHS, 2019). The presence of FORTIFIED homes on the Bolivar Peninsula were not as a result of state or local public policy mitigation programs, but driven directly by homeowners who saw the value of the program; however, with regard to market outlook for FORTIFIED it is a positive to see property owners taking independent mitigation efforts even in absence of incentive programs.

In recent years when advertising the availability of Community Development Block Grant Disaster Recovery (CDBG-DR) funds, the U.S. Department of Housing and Urban Development has encouraged recipients to build to the FORTIFIED Home standard. Following Hurricane Harvey the General Land Office in Texas adopted the FORTIFIED standard in their Housing Guidelines for low and moderate income units. (Texas General Land Office, 2018)

National

National Mitigation Investment Strategy (NMIS) & The Shelter Act

A new Senate bill introduced in June of this year, known as Shelter Act, would provide as much as $5,000 in tax incentives for modifications to homes that mitigate damage from extreme weather. Various modifications would qualify for the incentive, among them, homes modified to FORTIFIED standards (Simmons, 2019). The bill which mirrors aspects of its predecessor, Disaster Saving Resilient Construction Act (filed 2012, 2013, 2015, and 2018) proposes a federal tax incentive with focus on encouraging pre-disaster mitigation versus supplying post-disaster support. The various state level programs discussed above serve as prototypes of what can be achieved through a federal level program like the Shelter Act. Further, federal recognition of resilient building standards like FORTIFIED has the potential to facilitate synergies in disaster mitigation.

Another effort at the national level is seen in the National Mitigation Investment Strategy (NMIS). NMIS was introduced this month by the Mitigation Framework Leadership Group (MitFLG). In its executive summary MitFLG highlights three main goals of NMIS; (i) show how mitigation investments reduce risk; (ii) coordinate mitigation investments to reduce risk; and (iii) make mitigation investment standard practice (Mitigation Framework Leadership Group, 2019). In its recommendation the Strategy specifically points to FORTIFIED as a model for standard mitigation practice.

FORTIFIED is largely regarded as the national resilient construction standard with recognition from the Department of Housing and Urban Development, FEMA, and the Small Business Association. Increasing focus across a broad range of stakeholders in facilitating adaptive mitigation strategies has the potential to rapidly increase the development of safer, stronger, and more resilient homes. In the past, FORTIFIED expansion has been supported by a variety of incentive programs at the state and local level. Such incentive programs have typically included tax credits and/or mitigation grants or loan financing. Federal mitigation standard could facilitate an alignment of state and local practices and stakeholders.

3. Is There Value?

Previous studies on insurance-mitigation strategies highlight the perceived lack of affordability or the limited return on investment for property owners to undertake fortifying their properties. Absent of insurance incentive, savings from mitigation are not actualized until a disaster strikes (Maroney, Medders, & Nyce, 2015). Public policy encouraging or mandating insurance discounts for mitigation serve to push homeowners to act and help programs like FORTIFIED gain traction.

Not only is there value in the annual insurance savings, an independent study conducted by the Alabama Center for Insurance and Information in conjunction with Auburn University and University of Mississippi, that retrofitting a home to a FORTIFIED designation increased the value of homes in the study by ~7.0%. The study further highlights the economic benefit of FORTIFIED, noting average costs of retrofitting is frequently less than 7.0% (Awowndo, Hollans, Powell, & Wade, 2018).

An expansion of grant programs like Strengthen Alabama Homes, and SC Safe Home could encourage homeowners to take on the mitigation efforts to retrofit to FORTIFIED standards and increase their homes value.

Further, there is interesting thought in targeting new home construction where developers can bake in the costs of FORTIFIED construction into the overall home construction. The National Institute of Building Sciences Multihazard Mitigation Council (MMC) undertook a study on the value of mitigation in 2017. Through their analysis, they found that the aggregate benefit-cost ratio (BCR) across all states, if all new homes were built to the FORTIFIED Home program level for one year, is approximately 5:1; that’s $5 dollars saved for every $1 spent on building resilient new buildings (National Institute of Building Sciences, 2018).

The value of pre-disaster mitigation incentives and programs like FORTIFIED goes beyond the benefit of short-term home valuations though. Over the long term, mitigation efforts trade off investments today to protect against devastating loss in the future. Multiple stakeholders stand to benefit from resilient home building, including property owners, government, insurers, financial institutions, and builders. Improving structural resiliency reduces collective vulnerability of communities, protects against loss of life, and facilitates swifter socio-economic recovery.

References

Awowndo, S., Hollans, H., Powell, L., & Wade, C. (2018, December 26). Estimating the Effect of FORTIFIED Home Construction on Resale Value. Tuscaloosa, Alabama, United States: University of Alabama, Culverhouse College of Commerce. Retrieved from https://aciir.culverhouse.ua.edu/wp-content/uploads/sites/26/2018/12/FORTIFIEDReport_V2__2_.pdf

Coastal Alabama Partnership . (2015, November 11). Alabama Leads the Nation in FORTIFIED Construction. Retrieved from coastalalabama.org: http://coastalalabama.org/alabama-leads-the-nation-in-fortified-construction/

Efstathiou Jr., J., & Gopal, P. (2019, May 11 ). This House Is Built to Stare Down a Hurricane. Retrieved from Bloomberg Technology .

IBHS. (2019). Alabama FORTIFIED Discount Sheet . Retrieved from Smart Home America: https://www.smarthomeamerica.org/assets/uploads/Alabama-FORTIFIED-Discount-Sheet-2019.pdf

IBHS. (2019). Fortified Home FAQs. Retrieved from Fortified Home : https://fortifiedhome.org/faqs/

IBHS, I. I. (2019). Coastal Hazards: The Imporatance of “Going Green and Building Strong”. Retrieved from IBHS.org: https://ibhs.org/public-policy/coastal-hazards-going-green-and-building-strong/

Maroney, P. F., Medders, L. A., & Nyce, C. M. (2015). Public Policy and Regulation to Reduce Underlying Risks. Journal of Insurance Regulation.

Mitigation Framework Leadership Group. (2019). National Mitigation Investment Strategy. United States, Homeland Security, FEMA, Washington D.C.

Mize, R. (2018, September 1). Construction topics frame Oklahoma Building Summit. The Oklahoman. Oklahoma City, Oklahoma.

National Institute of Building Sciences. (2018). Natural Hazard Mitigation Saves: An Independent Study to Assess the Future Savings from Mitigation Activities.

National Oceanic and Atmospheric Administration. (n.d.). Billion-Dollar Weather and Climate Disasters. Retrieved from National Centers for Environmental Information: https://www.ncdc.noaa.gov/billions/overview

National Oceanic and Atmospheric Administration. (n.d.). Weather Disasters and Costs. Retrieved from Office of Coastal Management: https://coast.noaa.gov/states/fast-facts/weather-disasters.html

Oklahoma Insurance Department. (2017). 2017 Statute & Rule Changes. Oklahoma. Retrieved from https://www.ok.gov/oid/documents/090817_2017%20Legislative%20Update%209-18-17.pdf

Sharp, J. (2019, February 1). Alabama leads nation in building the strongest hurricane-resilient homes. Retrieved from AL.com: https://www.al.com/hurricane/2019/02/alabama-leads-nation-in-building-stronger-hurricane-resilient-homes.html

Simmons, K. (2019, July 26). Senate ‘Shelter Act’ is a welcome step toward fortifying U.S. homes to withstand extreme weather. Washington Post.

South Carolina Department of Insurance . (2016). Homeowners Mitigation Credits . Columbia: South Carolina Department of Insurance .

Texas General Land Office. (2018). Texas General Land Office Community Development & Revitalization. Retrieved August 23, 2019, from Texas General Land Office: https://recovery.texas.gov/